Resource Archive

About the Tennessee Historic Buildings Revitalization Act - 2020

The Tennessee Historic Buildings Revitalization Act will encourage private investment back into our smaller, rural towns by offering a tax incentive for the qualified rehabilitation of our state’s historic buildings to preserve our past and transform our future.

TN Historic Buildings Revitalization Act - 2020 Legislation Introduced in the Tennessee General Assembly

SB2837 (Watson, Lundberg) | HB2675 (Vaughan, Lamberth, Lynn, Crawford)

An act to amend Tennessee Code Annotated, Title 4, Chapter 11, Part 1; Title 4, Chapter 17; Title 56, Chapter 4; Title 66 and Title 67, relative to tax credits for the rehabilitation of historic structures.

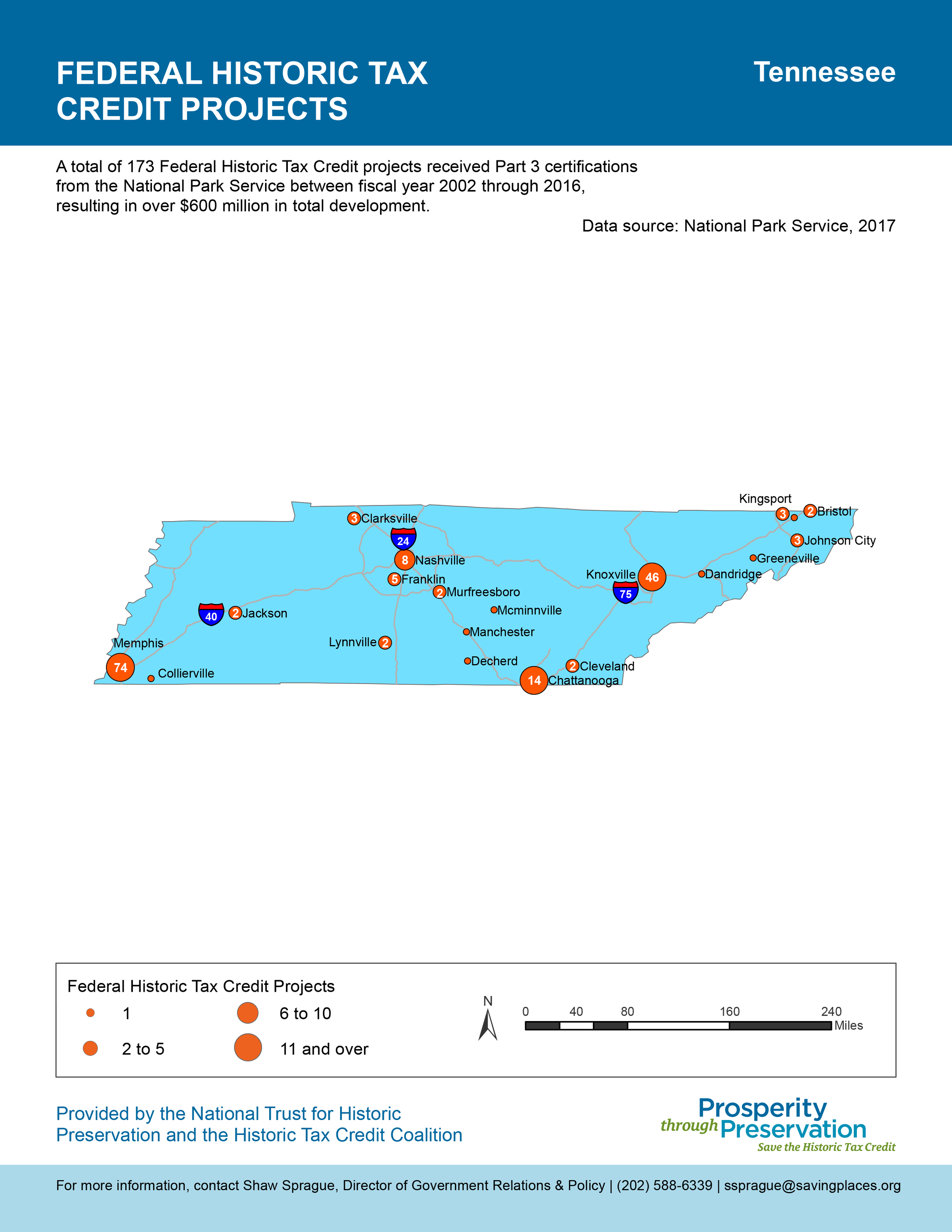

Federal Historic Tax Preservation Projects in Tennessee (2002-2016)

A total of 173 Federal Historic Tax Credit projects received Part 3 certifications from the National Park Service between fiscal year 2002 through 2016, resulting in over $600 million in total development. This report lists all of these projects. Without this critical funding, some of these projects never would have happened.

Mayors Supporting A Historic Rehabilitation Credit for Tennessee, 2019

April 3,2019, letter to Governor Lee sent by city and county mayors in support of the bill.