Resources and Downloads

2021 TN Historic Revitalization Act

Sponsored by Senator Lundberg and Representative Vaughan.

2021 Legislative Outline for SB0678 / HB 1354

This proposed legislative framework is intended to guide conversations for the creation of a Tennessee HTC Pilot Program.

Letter from Mayors to Governor Lee in Support of a State Historic Rehabilitation Credit, 2021

A letter to Governor Lee sent by city and county mayors in support of the bill on February 1st, 2021.

Rural Prosperity Through the Arts & Creative Sector: A Rural Action Guide for Governors and States

This Rural Action Guide describes in detail the principles of arts-based rural development, including the following: Creative sector initiatives are most effective when attuned to the particular creative assets and needs of rural communities. Creative sector initiatives work best as part of a cohesive economic development plan in rural areas. Creative sector initiatives add value when integrated with additional state and local policies and practices such as workforce development, community development and housing.

“The rural systems change framework supports five key ingredients for action by governors and their states:

Provide leadership for the state’s creative sector to benefit rural communities.

Capitalize on existing regional cultural assets.

Build state infrastructure for cultural and creative partnerships.

Develop local talent and human capital with creative skills.

*Create an environment friendly to investment and innovation.”

*Includes Advocating for historic tax credits as a state policy - See page 50.

Tennessee’s Historic Preservation Plan 2019-2029

The Tennessee Historical Commission is the state agency responsible for the stewardship of historic resources in Tennessee.

Celebration of the THC’s one hundredth anniversary in 2019 appropriately coincided with preparation of a strategic historic preservation plan to guide activities through 2029.

A goal from their plan is to, “develop and promote preservation practices that protect historic resources.”

In many cities, zoning, land use policies, and financial incentives favor new construction, resulting in a persistent misperception of preservationists who oppose continual demolition of historic resources as obstructionists to economic growth and “progress.” - See page 50

Preservation efforts in Tennessee are severely hampered by the lack of a state historic tax credit for rehabilitation of historic structures - See page 66

2019 Annual Report on Economic Impact of the Federal Historic Tax Credit

The Federal Historic Preservation Tax Incentives program encourages private sector investment in the rehabilitation and re-use of historic buildings. It creates jobs and is one of the nation's most successful and cost-effective community revitalization programs. For the past 42 years the NPS, in partnership with the State Historic Preservation Offices, has administered the Federal Historic Preservation Tax Incentives Program.

“The benefits of investment in HTC-related historic rehabilitation projects are extensive, increasing payrolls and production in nearly all sectors of the nation’s economy.“ - See page 2

Executive Summary: State Historic Tax Credits Report

This report distributed by the National Trust for Historic Preservation provides state and local policymakers a guide to understanding the benefits of historic rehabilitation and key factors for structuring an effective state historic tax credit program. (Note: Two more states have passed a state historic tax credit since the release of this report.)

Full Report: State Historic Tax Credits

The National Trust envisions a future where leaders who make decisions impacting our neighborhoods consider the reuse of historic buildings an essential strategy to create more inclusive, prosperous, and resilient communities. The National Trust has long supported the enactment of state historic tax credits (HTC) as a way of promoting building reuse. (Note: Two more states have passed a state historic tax credit since the release of this report.)

Tennessee Historic Project: Case Studies

This is a list of projects that were completed in Tennessee utilizing the Federal Historic Tax Credit as well as a list of potential projects in Tennessee.

Developed by a coalition of partners across the state in 2017.

Tennessee Historic Project: Potential Projects

These are the type of projects that could happen if the Tennessee Historic Rehabilitation Investment Incentive passes.

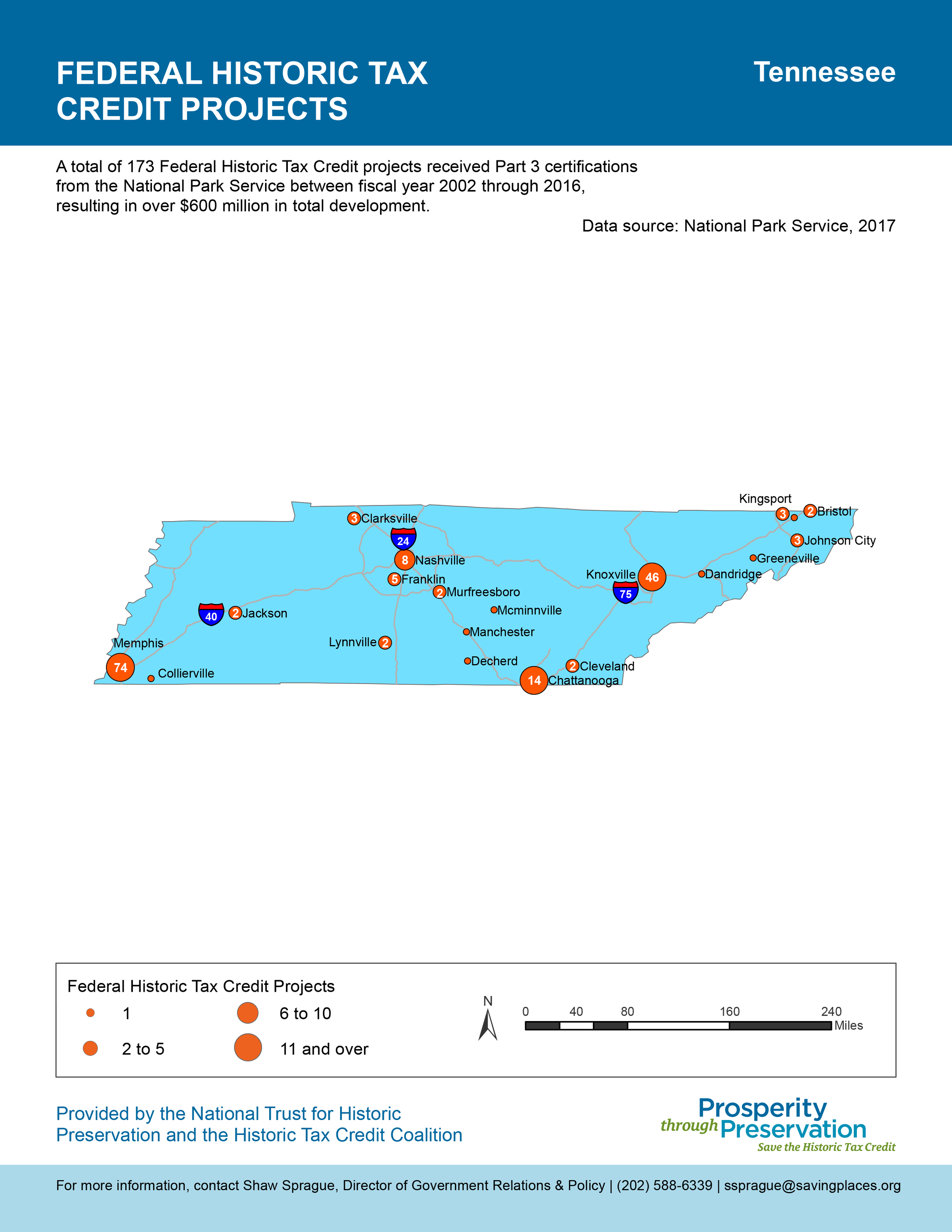

Federal Historic Tax Preservation Projects in Tennessee (2002-2016)

A total of 173 Federal Historic Tax Credit projects received Part 3 certifications from the National Park Service between fiscal year 2002 through 2016, resulting in over $600 million in total development. This report lists all of these projects. Without this critical funding, some of these projects never would have happened.

2020 Report on Historic Preservation Tax Credits in Texas

Enacted in 2013, the Texas Historic Preservation Tax Credit (THPTC) has driven significant increases in historic preservation projects across the state. Since January 2015, 243 projects have been completed and certified, representing total investment of over $2.6 billion.

Novogradac Historic Tax Credit Mapping Tool

This tool and the data in the searchable map below reflects historic tax credit investments made from 2001 through September 2018 based on Part 3 data from the National Park Service. The congressional district boundaries shown are based on those set for 116th Congress and members are accurate of March 2019.